Leverage Forex

At the most fundamental level, margin is the amount of money in a trader's account that is required as a deposit in order to open and. Leverage forex easy to learn guides and broker reviews.

Leverage merupakan nilai ungkit dari dana yang terdapat pada akun trading kita.

Leverage forex. With leverage, though, investors are able to maximize returns (and also losses) by having more money at their disposal. This is because the us regulation forbids forex brokers in the united states to offer leverage above 50:1 or 2%. Forex trading in the usa is regulated by the nfa (national futures association) and the cftc.

Maksudnya begini, broker memberikan pinjaman dana kepada kita untuk memperbesar size lot transaksi. 50:1 leverage is the maximum amount of leverage aloud within the united states. The $1,000 deposit is “margin” you had to give in order to use leverage.

Tetapi ada juga broker yang menawarkan leverage rendah seperti 1:200 hingga 1:50 atau dibawahnya. Leverage adalah sejumlah uang yang disediakan oleh broker forex kepada trader agar dapat menyelesaikan transaksi di pasar keuangan dalam jumlah yang jauh lebih besar menjadi berlipat ganda. Leverage in forex trading in the foreign exchange markets, leverage is commonly as high as 100:1.

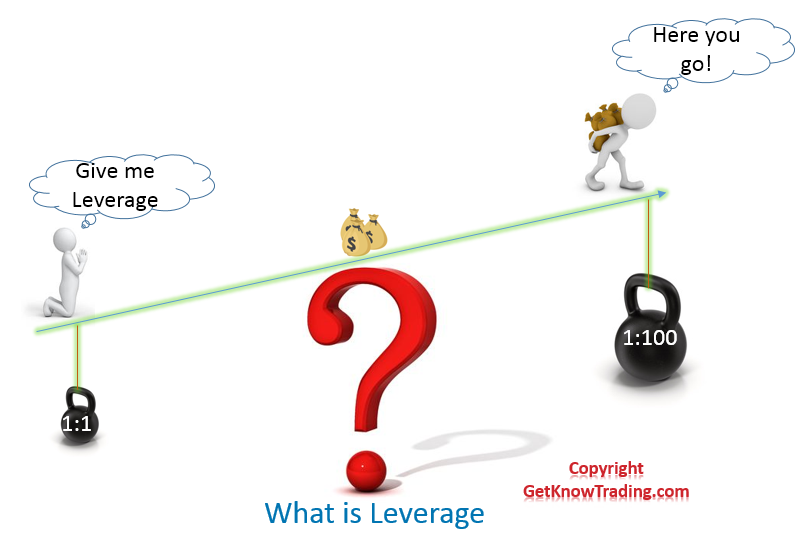

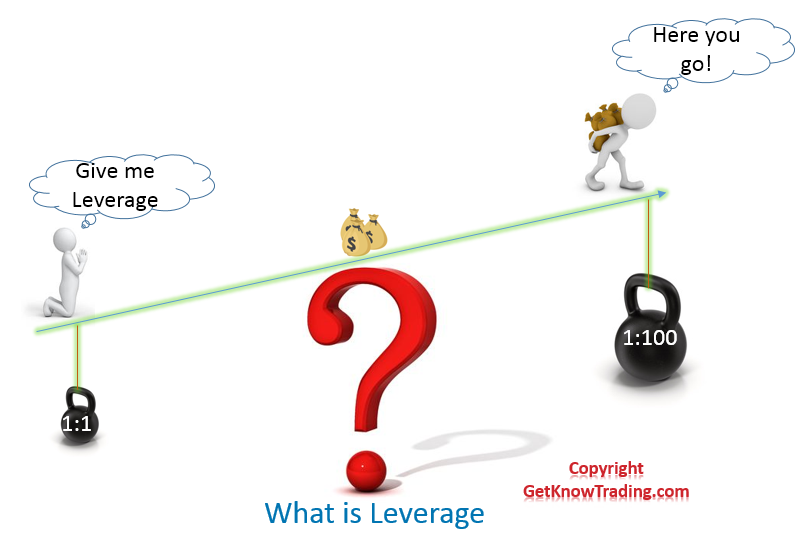

Best leverage in forex trading depends on the capital owned by the trader. In other words, it is a way for traders to gain access to much larger volumes than they would initially be able to trade with. Leverage is the use of borrowed money (called capital) to invest in a currency, stock, or security.the concept of leverage is very common in forex trading.by borrowing money from a broker.

Forex leverage help traders to open a big trading position. This means that for every $1,000 in your account, you can trade up to $100,000 in value. The reason leverage exists is that currency valuations are small in nature from day to day.

Dengan menggunakan leverage, maka trader dapat meningkatkan jumlah modalnya sebanyak puluhan kali lipat bahkan ribuan kali. Leverage of 1:100 means that with $500 in the account, the trader has $50,000 of credit funds provided by the broker to open trades. Brokers that offer its clients 500:1 or more leverage can be dangerous to unexperienced traders.

It is agreed that 1:100 to 1:200 is the best forex leverage ratio. If you have realized anything about forex trading or forex brokers, its that most offer an extreme amount of leverage. Selanjutnya mari kita bahas mengenai leverage.

The price has just broken out of a range, and your analysis shows that there is further upside potential in the pair. Seringkali kita mendapati suatu broker yang menawarkan leverage sangat tinggi sekali hingga 1:1000 atau bahkan 1:3000 atau lebih. In forex, to control a $100,000 position, your broker will set aside $1,000 from your account.

The buying or selling of a forex contract is done in terms of lots, and a standard lot represents 100,000 of the base currency. Generally speaking the euro only moves 1 or 2 cents from day to day. View our complete list fo the best high leverage forex brokers on the planet.

Margin and leverage are among the most important concepts to understand when trading forex. For example, if $1000 is invested and the leverage is equal to 1:100, the total amount available for trading will equal to $100.000. So, leverage in forex is the ratio of the trader's funds to the size of the broker's credit.

With the help of this construction, a trader can open orders as large as 1,000 times greater than their own capital. Leverage dalam forex dapat dimaknai sebagai perbandingan antara besaran modal trader dengan besaran dana yang dipinjamnya dari broker. How is life with leverage in the forex market?

Ifc markets offers leverage from 1:1 to 1:400. Spot gold and silver contracts are not subject to regulation under the u.s. The short answer is no.

Keberadaan leverage sebenarnya sangat berguna karena memberi kesempatan masyarakat dari berbagai kalangan untuk terjun pada bisnis forex. High leverage forex brokers what is forex broker leverage? So 1:100 leverage is the best leverage to be used in forex trading.

Usually in forex market 1:100 leverage level is the most optimal leverage for trading. Pada pembahasan diatas, disinggung juga masalah leverage pada akun trading kita. Financial leverage is essentially an account boost for forex traders.

What is leverage in forex? How to trade forex, and market news alongisde the award winning brokers of 2020. This means a trader can enter a position for $10,000.

For example, the eur/usd has the pip value equal with $10. Arti leverage dalam trading forex. The advantage of leverage when trading forex.

You’re now controlling $100,000 with $1,000. It is very common to see leverage of 50:1 to 500:1 or even more. Penggunaan leverage dalam trading forex.

Your leverage, which is expressed in ratios, is now 100:1. These essential tools allow forex traders to control trading positions that are substantially greater in size than would be the case without the use of these tools. Forex trading involves significant risk of loss and is not suitable for all investors.

If you have a relatively small deposit and use the leverage, you can buy several times more currency or stocks, and so, make several times more profit. Umpamanya, bila anda membuka rekening dengan leverage 1:200, berarti dengan menyediakan modal sebesar 1 dolar, anda bisa menggerakkan dana sebesar 200 dolar, dengan 199 dolar darinya merupakan dana pinjaman. Let’s say you have $10,000 in your trading account and want to trade the usd/cad currency pair.

For the same $5000 account, leverage of 50:1 will allow you to control 250.000 units, of the base currency. Gain capital group llc (dba forex.com) 135 us hwy 202/206 bedminster nj 07921, usa. Leverage is a double edged sword, […]

Simply, leverage tool opening opportunities to your trading account. The forex trading indeed is known for its leveraged trading possibility, which means that the trader is able to use the leverage strategy or “borrowed” capital as its funding source. Jika dahulu market forex hanya dimonopoli para investor kelas kakap dan lembaga keuangan, sekarang siapa pun dapat berpartisipasi dalam forex.

Forex leverage explained in simple terms is a kind of the bank loan provided by the broker to the forex trader. Leverage in forex is a useful financial tool that allows traders to increase their market exposure beyond the initial investment (deposit).

Forex Leverage Explained For Beginners & Everyone Else

Forex Leverage Explained For Beginners & Everyone Else

Leverageforex in 2020 Forex brokers, Forex, Forex trading

Leverageforex in 2020 Forex brokers, Forex, Forex trading

What is Leverage in Forex Trading? TFF Group

What is Leverage in Forex Trading? TFF Group

The Principle Of Leverage And Its Applications On The

The Principle Of Leverage And Its Applications On The

Forex leverage explained by MT YouTube

Forex leverage explained by MT YouTube

What is Leverage in Forex and How to Use It

What is Leverage in Forex and How to Use It

Understanding Leverage In Forex Capital One Forex

Understanding Leverage In Forex Capital One Forex

FOREX TRADING LEVERAGE SWAP RATE TERMS YouTube

FOREX TRADING LEVERAGE SWAP RATE TERMS YouTube

What Leverage is Best in Forex? (Based on your account

What Leverage is Best in Forex? (Based on your account

9 Cara untuk Menghindari Kehilangan Uang dalam Forex

9 Cara untuk Menghindari Kehilangan Uang dalam Forex

What is Leverage in Forex Trading The Best Leverage

What is Leverage in Forex Trading The Best Leverage

What is Leverage and How It is Used in Forex?

What is Leverage and How It is Used in Forex?

Best Leverage for Forex Trading What Ratio is Good for

Best Leverage for Forex Trading What Ratio is Good for

An Explanation of Leverage in Forex Trading Online

An Explanation of Leverage in Forex Trading Online

How Forex Leverage Works Trading and Investment

How Forex Leverage Works Trading and Investment

Forex News 🔴 What is FOREX Leverage ? Advantages

Forex News 🔴 What is FOREX Leverage ? Advantages

How to earn massive profit with forex leverage

How to earn massive profit with forex leverage

Comments

Post a Comment